Last updated on April 4th, 2025 at 12:53 pm

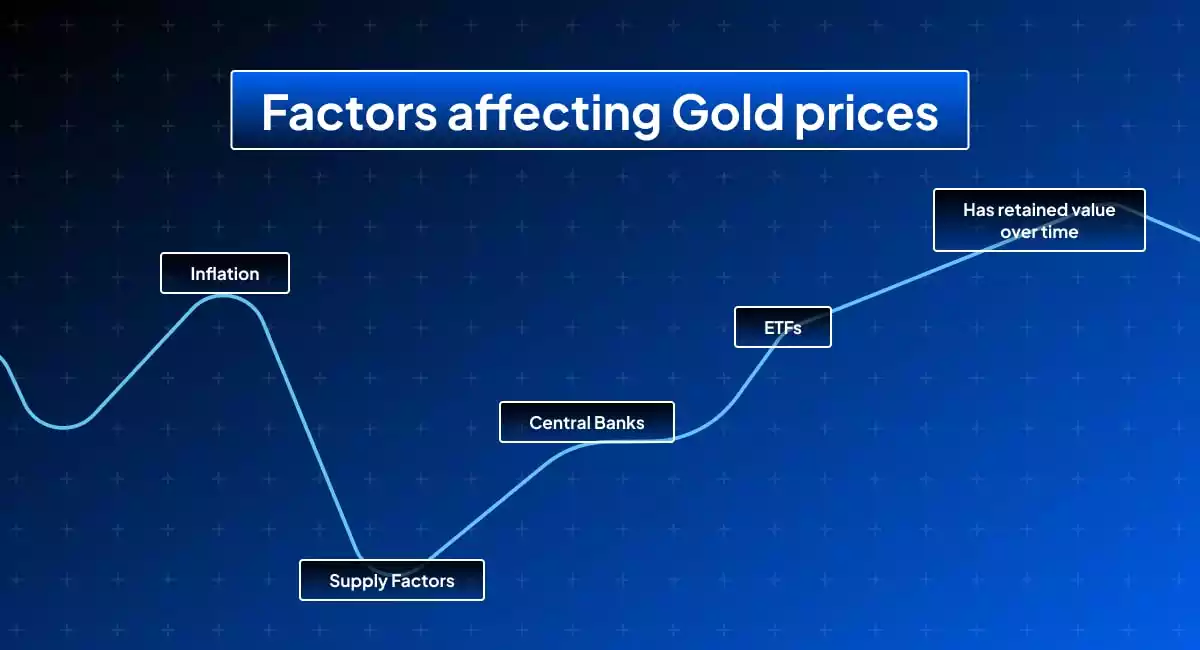

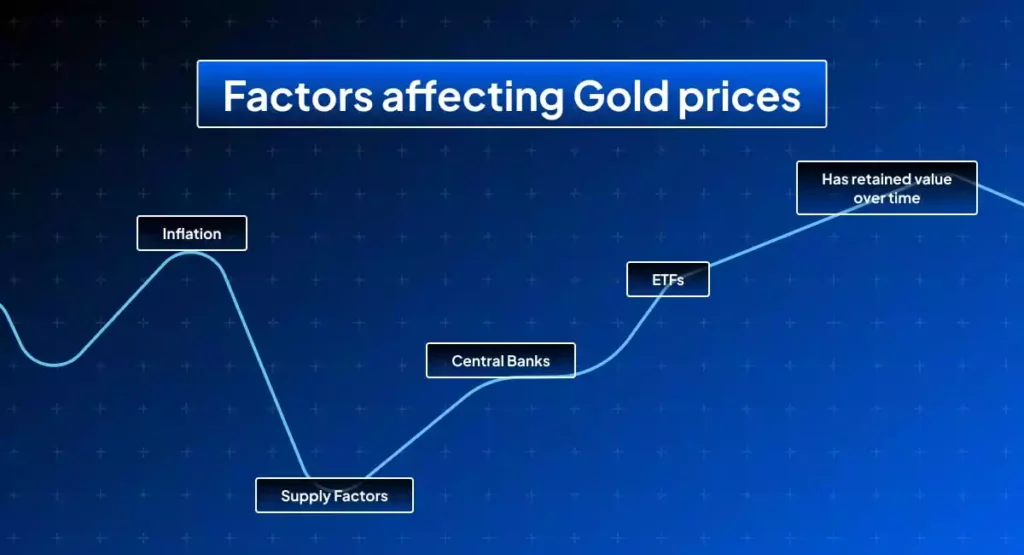

For a long time, gold has been seen as a safe-haven asset that draws investors in difficult economic times. The intricate link between supply and demand is the basis of this thinking. Understanding these forces helps traders make informed decisions, capitalize on price fluctuations, and refine their strategies.

Mastering how to trade gold requires more than just understanding charts and technical indicators. Recognizing the broader economic and market factors that shape supply and demand gives traders an edge. Let’s explore the key factors shaping gold prices and how traders can leverage this knowledge.

The Role of Central Banks in Gold Supply

Governments and financial institutions hold vast reserves of precious metals, impacting global availability. Central banks play a crucial role in the markets, as their buying and selling activities influence supply levels. When a country’s reserve bank accumulates more bullion, supply tightens, leading to upward pressure on prices.

On the other hand, large-scale sell-offs can flood the market, causing price drops. Additionally, monetary policies impact supply through interest rate decisions and currency valuations. When interest rates are low, central banks often increase purchases to hedge against inflation and economic downturns. Traders closely monitor these activities as they provide insight into potential market trends and future price movements.

How Mining Production Affects Market Availability

The supply of gold depends heavily on mining operations worldwide. Production levels fluctuate due to geological discoveries, mining costs, and regulatory factors. When new gold deposits are found, supply increases, potentially stabilizing or lowering prices. Conversely, declining production due to rising costs or government restrictions leads to supply shortages, pushing prices higher.

Major gold-producing countries like China, Russia, and Australia significantly impact global supply. When mines operate at full capacity, availability increases, but production slowdowns can trigger market concerns. Traders track mining reports and production data to anticipate price shifts and adjust their strategies accordingly.

Industrial and Technological Demand for Gold

Beyond investment purposes, gold has widespread applications in technology, healthcare, and manufacturing. The electronics industry relies on it for its conductivity and corrosion resistance, while the medical sector uses it for specialized treatments and devices. These industrial demands create a steady need for gold, contributing to price stability.

When technological advancements increase demand for gold components, market value often rises. In contrast, a slowdown in industrial consumption can reduce demand pressure. Traders analyzing these trends can better predict long-term price movements and adapt their trading approaches accordingly.

The Influence of Jewelry Markets and Consumer Demand

Gold’s cultural significance fuels consistent demand in the jewelry sector. Countries like India and China, where it is traditionally valued for weddings and religious ceremonies, drive a significant portion of global consumption. Seasonal trends, festival periods, and economic prosperity all influence how much consumers are willing to spend on gold jewelry.

When consumer demand surges, gold prices typically follow, creating buying opportunities for traders. However, economic downturns and shifting fashion trends can weaken demand, leading to lower prices. Monitoring global consumer behavior helps traders anticipate these fluctuations and make informed market decisions.

Investor Sentiment and Safe-Haven Demand

During economic instability, investors turn to gold as a store of value. Market uncertainty, stock market volatility, and geopolitical tensions boost demand for safe-haven assets, pushing gold prices higher. When confidence in financial markets improves, demand often declines as investors shift toward riskier assets.

Global events, such as wars, inflation surges, and banking crises, significantly impact the demand. Traders who monitor economic indicators and geopolitical developments can capitalize on these shifts. Understanding how investor psychology influences market trends allows traders to enter or exit positions strategically.

The Impact of Inflation and Currency Movements

Gold prices often move in response to inflation trends and currency fluctuations. When inflation rises, the purchasing power of fiat currencies weakens, making gold more attractive as a hedge. As a result, higher inflation levels typically drive increased demand, leading to price appreciation.

Similarly, currency devaluation affects gold prices, particularly when the U.S. dollar weakens. Since gold is priced in dollars, a declining currency makes it more affordable for international buyers, increasing demand. Traders keeping a close watch on inflation data and forex markets can gain valuable insights into potential gold price trends.

Trading Gold with a Supply and Demand Perspective

Understanding supply and demand dynamics helps traders develop effective strategies. By analyzing production trends, central bank activities, consumer behavior, and economic indicators, traders can anticipate price movements and optimize their positions. Successful traders integrate both fundamental and technical analysis to make informed decisions.

While supply and demand factors provide a long-term perspective, chart patterns, price trends, and volume analysis help identify entry and exit points. Adapting to market conditions and staying informed about macroeconomic trends ensures traders remain ahead of price fluctuations.

Navigating the gold market requires a deep understanding of supply and demand fundamentals. Recognizing these elements allows traders to anticipate shifts and make strategic trading decisions. Mastering how to trade gold involves staying informed, adapting to market trends, and leveraging both economic insights and technical strategies. With the right approach, traders can harness gold’s potential to build a profitable and resilient investment portfolio.